A multitude of firms, including second-tier banks, microcredit financial institutions, some of which charge extremely high interest rates, or even those that forcefully collect debts, are controlled by a “hand”. The owners of ABI BANK run a network of firms, which only grows day by day, with the aim of losing track of where Albanians’ money goes.

The same owners control the granting of loans, to individuals or businesses with collateral. The same are also those who provide microcredit, where the interests are extremely high. But their most profitable tool is debt collection, since they also control a financial institution.

The money is suspected of moving outside Albania, to offshore countries, from those countries whose origin is not declared and no one is held responsible. But the same individuals have also entered the construction sector, in Tirana or even in coastal countries, creating a money laundering chain. A file worthy of the Special Prosecution Office, as there are very high suspicions of money laundering.

At the head of this scheme stands ANDI BALLTA, who controls this entire chain, headed by the Tranzit firm. This firm, created to collect bad debts, owns Abi Bank, NBG Bank, the financial institution NOA, which it purchased at the beginning of 2025. The Tranzit firm also owns the Moscopole firm. Moscopole owns the MA1 company, or even the newly created construction firm BAY VIEW ALTERNATIVE INVESTMENT. The latter will develop a huge 32-hectare property in Poro, Vlora, left as collateral to ABI BANK.

This firm was created in July 2025 by the American Investment Bank, which is also the owner with about 99% of the shares, while less than 1% of the shares are owned by Andi Ballta. The latter is also the owner since the American Investment Bank is in possession of TRANZIT, this TRANZIT itself is majority owned by Ballta. But, the strangest thing in this case is that the money of the banks, or that of the microcredit institutions, is being invested in a huge property, in the coastal area in Poro, Vlora.

But how was this property left as collateral in the bank? Who are the bad creditors? Are we dealing with a money laundering scheme? Was the property put up for auction, according to the regulations of the Bank of Albania?

A multitude of institutions should start controls on this huge scheme, which after having robbed the Albanians to the core, is now also taking their properties. A scheme that is being used massively in Albania, mainly by criminal groups, where the case of Rrumi i Shijaku is just the tip of the iceberg. The letters are open and investigations or checks, mainly by law enforcement institutions, are enough to trace the money, which after circulating in Albania, ends up in offshore countries.

At the head of the scheme is the company TRANZIT, which at the time previously it was a firm that dealt with the collection of bad debts, the same as Micro Credit Albania, ADCA or even FINAL. But, surprisingly, outside the investigations of the Tirana Prosecutor’s Office and later of SPAK, TRANZIT has remained, which already generates millions of euros in profits, mainly at the expense of poor Albanians.

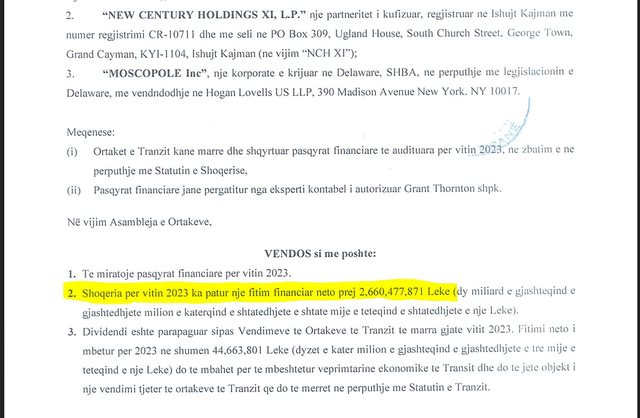

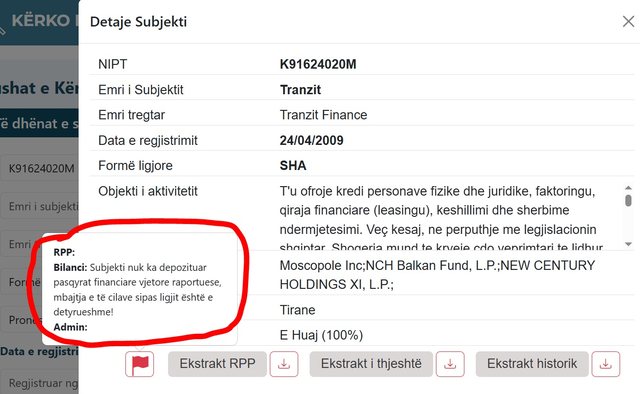

According to documents obtained by VoxNews, in 2023, at the peak of the debt collection scheme, TRANZIT would declare a colossal profit of 26 million euros. Meanwhile, the same firm has refused in 2025 to publish the balance sheet for 2024, in complete violation of the law.

Of course, the concealment of the balance sheet is done with the sole purpose of concealing the debt collection scandals, so as not to suffer the same fate as its sisters, now closed and in criminal and civil proceedings.

The microcredit scandal has only strengthened its role in this shameful market of Tranzit. With the maneuvers of the owner, Andi Ballta, Tranzit is now the parent company of other firms. Including ABI BANK itself!

The chain of companies is growing, as is their highly discussed portfolio. According to documents researched by VoxNews, ABI BANK has also extended its tentacles to financial institutions licensed by the Bank of Albania to provide microcredits, such as NOA.

With a highly suspicious transaction, in January 2025, ABI Bank purchased the NOA institution. Later, ABI BANK absorbed the NOA company and now they operate as a single body!

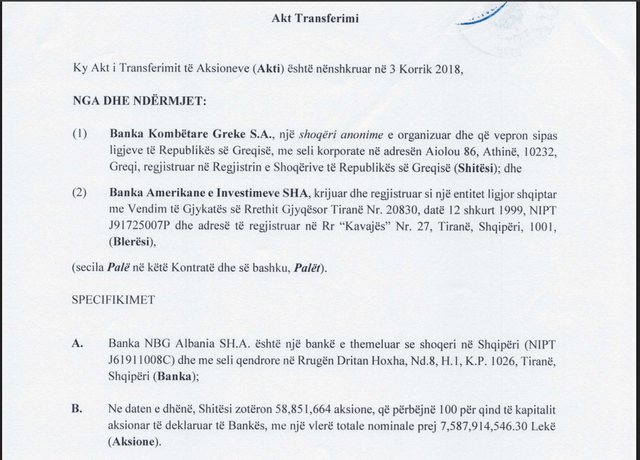

A few years ago, according to documents available to VoxNews, ABI BANK, headed by Andi Ballta, also bought NRG Bank for around 70 million euros, or as the Greek bank was otherwise known in Albania.

The transactions have already confirmed the total domination of the banking sector by the same hand, which seems to have connections up to the governing dome, since Mrs. Lindita Rama, wife of Prime Minister Edi Rama, was also a member of the Supervisory Council. But the same bank also has strong connections with the opposition, since Elvana Hana has held management positions.

It seems like a strong “shield” that ABI BANK has from the government or the opposition in Albania, where although it acts suspiciously, it has so far escaped any administrative control or criminal investigation. Perhaps these connections have helped it to increase the range of companies under its control day by day, where the focus is now on construction. /voxnews.al