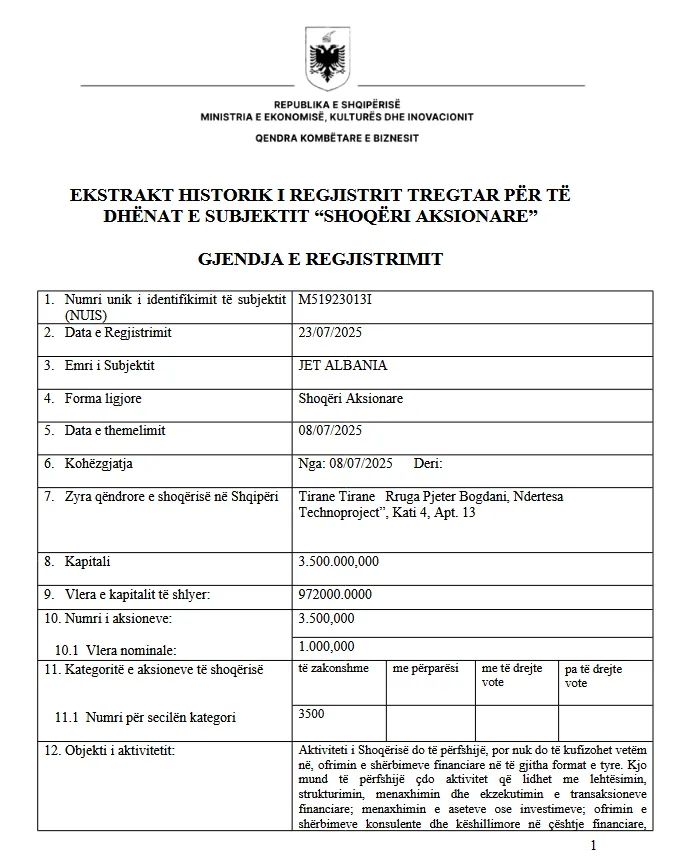

The Supervisory Council of the Bank of Albania has given preliminary approval for the licensing of “JET Bank”, a financial institution that aims to operate fully digitally and without physical branches — a step that marks the end of years without major innovations in the country’s banking system and a trend towards digital financial services.

According to official announcements, JET Bank was established in September 2025 with a relatively small initial capital (around 36,000 euro, or 3.5 million lek) with owner and founder Idan Avishai, a dual citizen, Israeli and British, reports Albeu.com.

According to the law, Jet Bank, which has received preliminary approval for a license, must meet all the conditions provided for in the law “On banks in the Republic of Albania” and the by-laws implementing it, within 12 months, in order to be provided with a license to start banking activities in our country.

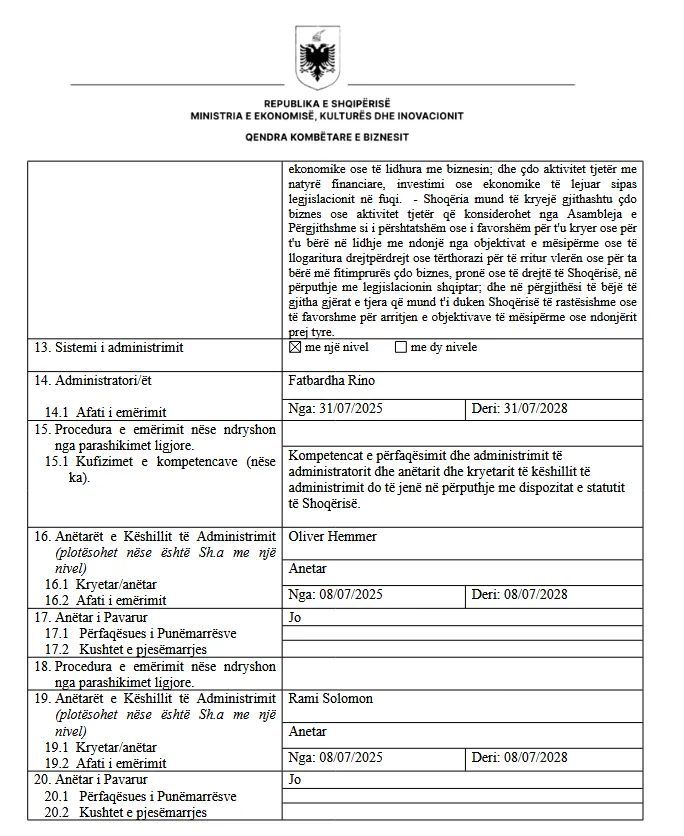

The bank’s administrator will be Fatbardha Rino, a well-known figure in the financial sector in Albania, having previously held management positions in second-tier banks as well as the position of executive director of Iute Pay, a financial institution often accused of manipulation and fraud with microcredits.

Other members of the bank’s board are Oliver Hemmer and Rami Solomon, also of Israeli origin.

Idan Avishai has so far kept a low profile and public information about him is scarce, while according to his Linkedin profile, his experience is mainly related to the activity of online trading platforms or as they are known in financial jargon “forex platforms”, reports Albeu.com.

Meanwhile, the other two Israeli names, board members, are almost anonymous with very little information on the internet, and raise questions about the bank’s goals and background, leaving room for uncertainty among the public and potential investors.

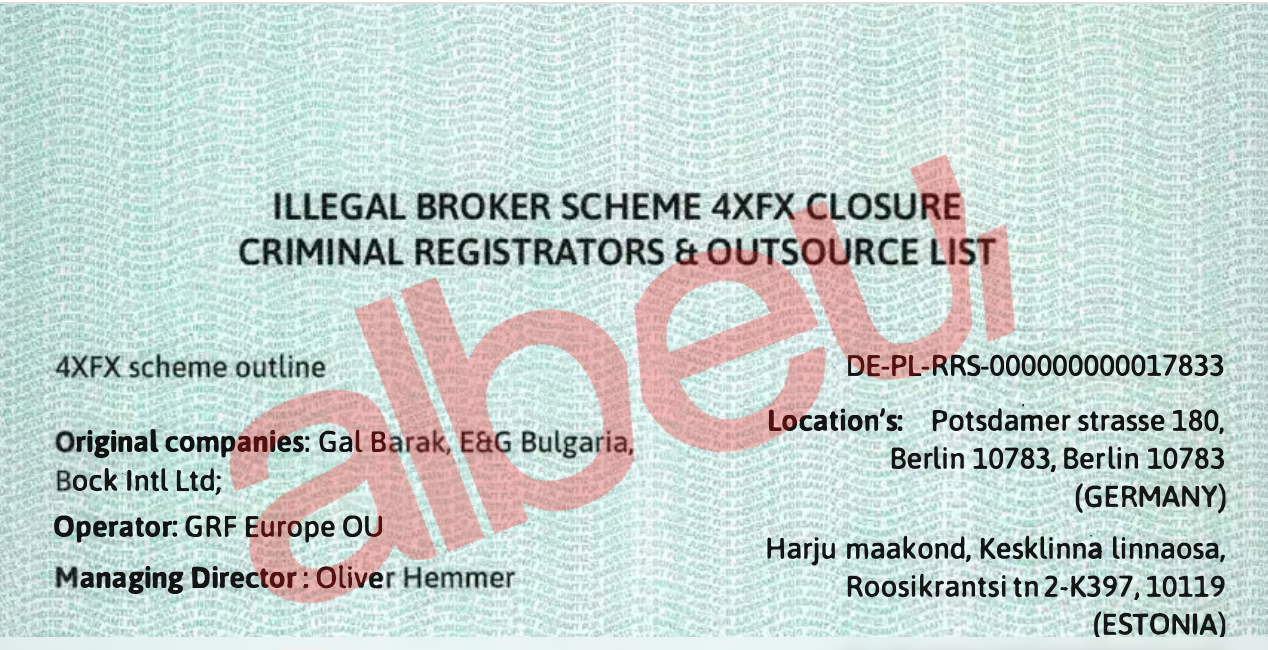

The only relevant information about Oliver Hemmer is a 2019 report that states that federal officials are investigating an unregistered company based in Berlin, Germany, called Gal Blocklntl Ltd (the “4XFX” platform), which was operating without proper authorization. According to the report, the company’s managing director, Oliver Hemmer, was running a fraud scheme called “4XFX” and that he was also being investigated as the main beneficiary. Reports have been filed about the company in the United Kingdom, Spain and Estonia, and Australia in this regard. (https://www.scribd.com/document/714449499/report-for-the-fraudulent-activities-4xfx-com)

Regarding the “4XFX” platform fraud scheme, important institutions have published notices denouncing the scheme. (Reported by the UK’s FCA and reported by the Australian Financial Supervisory Authority)

4XFX was a fraudulent and unregulated cryptocurrency and forex trading platform that targeted investors in multiple countries (UK, Canada, Australia) around 2019, claiming to offer bitcoin, gold and oil trading, but instead defrauding users, with regulators such as the FCA and MSC issuing warnings, and the platform’s website later being shut down. It is a classic example of an unlicensed scheme where users lose money, often leading to subsequent “recovery room” scams.

“Anonymous” foreign names opening companies in strategic sectors is a scheme known in the world, and often encountered in Albania, where foreigners are used to camouflage the real owners or investors of a business.

Meanwhile, economic experts call this project a “time mine for Albanians’ money,” highlighting the potential risks to the financial stability of the system if the new bank does not have a strong infrastructure, sufficient monitoring, or full transparency in operations.

Jet Bank becomes the second entity to enter the Albanian banking market after Ziraat Bank, marking a new expansion trend, bringing the number of commercial banks to 13. /albeu.com/